Yes, we have broken ground!

Click here for more information and details

Click here for our Pledge Form for the Capital Funds Campaign

A charitable donation of long-term appreciated securities, i.e., stocks, bonds and/or mutual funds that have realized significant appreciation over time is one of the best and most tax-efficient of all ways to give. This method of giving has become increasingly popular in recent years. There are two main advantages: 1) Any long-term appreciated securities with unrealized gains (meaning they were purchased over a year ago, and have a current value greater than their original cost) may be donated to the church with the benefit of receiving a tax deduction for the full fair value of the securities—up to 30% of the donor’s adjusted gross income; 2) since the securities/stock is being donated rather than sold, capital gains taxes from selling the securities no longer apply. And the more appreciation the securities have, the greater the tax savings will be.

O Lord, I love the habitation of Thy house, and the place where Thy glory dwells.” (Psalms 26:8) –

Click here for the full article

More Ground Has Been Broken!”

We have begun the dismantling of our “A” frame church structure following the demolition of our two duplex apartment building last spring. Our church has moved into its new temporary worship space in the former St. Michael Community Center where there is lots of room with ample air conditioning, great acoustics, and comfortable seating for up to 300. There will soon be more additional convenient parking for everyone as we proceed to plan for the construction of our new church sanctuary.

[masterslider id=”4″]

Frequently Asked Questions

The following article is part of a series being provided for to help in clarifying our St. Michael Building Fund Capital Funds Campaign.

What does the St. Michael Building Fund consist of?

The St. Michael Building Fund consists of contributions earmarked for the capital expenses necessary for the construction of the future church sanctuary. They include donations that are not part of the parish General Fund used for the month-to-month operating expenses of the church. Various line items of the Building Fund include:

- Regular contributions by parishioners who pledge to the Building Fund,

- Substantial gifts made by donors,

- Spiritual Bouquet contributions made by parishioners and friends of deceased parishioners,

- Memorial gifts and Trusts of deceased parishioners, and

- parish fundraisers.

How may one be a contributor to the Building Fund?

Any person or family can make a tax-deductible contribution by various means. Some of these include:

- fulfilling a pledge over a period of time

- becoming a building sponsor of the iconography and its corresponding structure of the future church

- Living Trust donations

- planning a family memorial by adding to an existing $10,000 or more Spiritual Bouquet memorial in the name of a departed loved one made by parishioners and friends, or

- assisting our Capital Funds Campaign by calling upon family members for a contribution or pledge to the fund.

donation of stock

How can I receive a tax benefit for my contribution?

While some wait until death in their estate planning to make a major contribution to the church, there is a greater tax benefit by making the donation while you are living. This is because you would receive both an income tax deduction while living, and later your family will benefit by a reduction on your estate tax, if it applies.

You should speak with your accountant or any member of the St. Michael Capital Funds Campaign Committee who would gladly answer your questions: Ron Zraick, Chair at:  , Charles Ajalat at;

, Charles Ajalat at;  , and John Andrews at

, and John Andrews at  .

.

Can I make a donation online?

Yes, please click here to make an online donation and please add a note to allocate the funds the building fund.

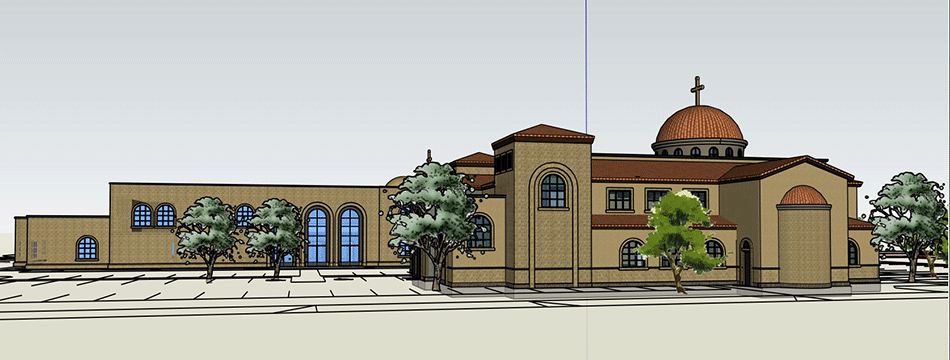

Are there more pictures of the plans for the new church?

Yes, here are the latest architect’s renderings and plans for the property.

14.0682 – (A-3.0) ELEVATIONS-ELEVATION

Church on Vanowen Approved 10-28-14 by PC

[masterslider id=”3″]